What's happening to the Toronto real estate market this summer?

Here's your quick summary of what's happening to the Toronto real estate market so far this summer.

Here's your quick summary of what's happening to the Toronto real estate market so far this summer.

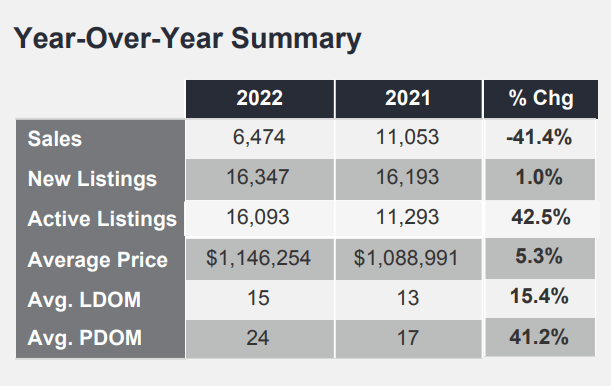

Drastic reduction in sales vs. 2021 & preceding months in 2022 for Toronto

- Detached = 30.8% decrease

- Semi = 41.8% decrease

- Townhouse = 42.6% decrease

- Condo = 38.5% decrease

More moderate levels of price appreciation throughout the 416

- Townhouses are leading the way with 9.1% annual appreciation (Avg. price = $1,027,050)

- Condos are appreciating at 7.4% (Avg. price = $771,267)

- Semi's are more moderate at 5.9% (Avg. price = $1,343,378)

- Detached homes saw the slowest rate of appreciation at 2.4% (Avg. price = $1,737,012)

Slightly more inventory in certain areas but still tight in others

- Bridle Path has seen an increase in inventory & a reduction in prices (30% drop in average sale price)

- Annex/Yonge/St. Clair area has performed the best with home prices rising by 24% month-over-month in June

Buyers are adjusting their purchasing habits because of rising interest rates but also a return to pre-COVID life as many return to the office for work and the vibrancy of the city has come back with events, restaurants, etc.

Softer prices for some homes & condos

- Lawrence West saw an almost 7% decrease month-over-month in June

- Vaughan (5.7%) & Brampton (7.2%) both experienced decreases

- Noticing a correlation between properties that don't have ideal views, layouts, etc. being more prone to these pricing decreases vs. homes/condos that have all of these attributes

Overall less competitive & fewer multiple offers

- Seeing more negotiation from list price in certain areas

- The days of drastically underpricing a property in hopes of generating lots of interest seems to be gone for now (thankfully)

- More reasonable listing prices that are closer to the end sale price (though there are still areas seeing properties sell for 130-140% of list price)

Potential opportunity for buyers who have been watching the market for the past couple of years

- Summer usually takes many buyers away on travel so there's less competition vs. the spring or fall markets

- Interest rates are also expected to rise again in the coming months so it will be more affordable right now

Ideal time for investors

- Rental prices are skyrocketing so it presents a unique opportunity for investors as cap rates could be more favourable than they have been in the past 2-4 years with softening prices in certain areas

As the market is continuously shifting right now, I'll be sure to keep you posted with any updates in the coming months!

Have any questions about buying, selling or investing right now?

Feel free to message me on Instagram or leave it in the comments section below!

Rylie C.