What impact has COVID19 had on the Toronto luxury real estate market in 2020?

With 2020 coming to a close, I thought it might be good to take a look at what has happened with the Toronto luxury real estate market since COVID19 hit earlier this year. More specifically, we'll look at the period from April 1st to November 1st which is historically our busiest time of the year.

With 2020 coming to a close, I thought it might be good to take a look at what has happened with the Toronto luxury real estate market since COVID19 hit earlier this year. More specifically, we'll look at the period from April 1st to November 1st which is historically our busiest time of the year.

To be classified as a "luxury" property, it must meet the following value requirements.

Condo

1-Bed/+Den = $900,000 +

2-Bed/+Den = $1,400,000 +

3-Bed/+Den = $1,600,000 +

House

3-Bed/+ = $1,500,000 +

4-Bed/+ = $2,000,000 +

5-Bed/+ = $2,500,000 +

Condos

The luxury condo sector has been relatively hot in Toronto over the past several years with consistent demand coming from people that wanted to enjoy the vibrant downtown lifestyle which was offered to them in neighbourhoods like Yorkville, the Entertainment District & King/Queen West.

COVID19 has had an impact on this lifestyle choice for some people, however when we look at the luxury condo market stats for this year, we can see that overall many people are still wanting to choose this kind of property. The biggest change is that they are looking for more interior & exterior space.

Unsurprisingly, 1-bed/+den units have seen a decrease in the # of sales & average sale price when compared to the same time period last year.

This is directly as a result of COVID19 changing home buyer habits to look for larger units due to the fact that so many more people are working, exercising & educating from home.

What is interesting here is that the average % of listing price is 100%, which indicates that for the most part, condos are being priced properly & buyers are willing to pay this without much negotiation.

2-bed/+den units faired slightly better with a 2% increase in average sale price compared to last year, however there was a substantial reduction of 21% in the # of sales.

It's hard to tell whether this is from less demand from home buyers or less supply from existing 2-bed condo owners who are reluctant to move at this time

The part that caught my eye the most was that the average % of listing price was 98%, which means that the condo owners are expecting more than what the market is willing to pay right now.

This is likely due to the fact this sector has seen explosive growth over the past 5 years, so it will take some time for them to adjust to our new “normal” market.

The one segment of the condo market which has performed quite well this year is the 3-bed/+den units with a 6.2% increase in the average sale price to just over $2.2 million.

While there was a slight reduction in the # of sales (3% decrease) compared to 2019, these units were selling 4% faster than last year with an average of 26 days on the market.

There seems to be some negotiation happening with these sales as the average % of listing price is currently 97%.

Semi-detached homes

There has been rampant demand for semi & detached homes this year as many people shift away from condo living and this is emblematic in the drastic increase in # of sales for 3-bed semi-detached homes which rose by 34% compared to 2019.

The average sale price climbed by 4% accordingly with this surge in demand to just under $2.1 million while the average days on market decreased by 33% to only 10 days (again another strong indicator of the demand for this sector).

It seems that the strategy for majority of these 3-bed semi’s is to underprice & hold off on offers, thus the 102% of listing price stat.

While there aren’t all that many luxury 4-bed semi-detached homes in the city, we did see an uptick across the board for this segment with an increase in the # of sales (+38%), an increase in average sale price to just under $3 million (+3%) & an increase in average days on market (up 10% to 22 days).

These properties appear to have been priced right at market value as the average % of listing price was 100%.

For 5-bed semi-detached homes we again did not have a huge amount of sales in this segment, however we did see another increase across the board for average stats which would indicate these type of properties are in demand right now more so than they were during the same period in 2019.

Detached homes

The flight away from the luxury condo market has pushed many home buyers to look at a fully detached home for more space & privacy.

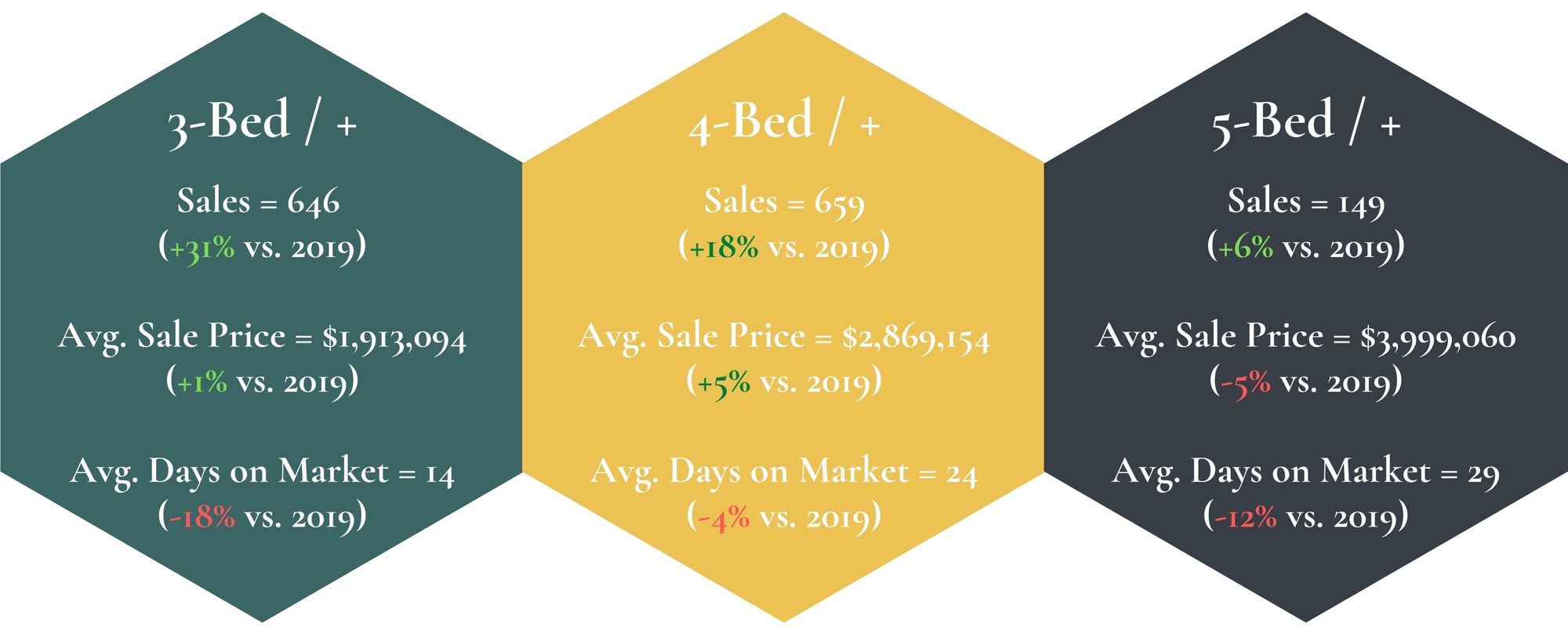

This is highlighted when looking at the stats for 3-bed detached homes which have seen a 31% increase in the # of sales compared to 2019 while also experiencing a 18% decrease in the average days on market.

Both of these stats show this segment is in high demand & is further backed up by the average % of listing price being 103%.

Without a doubt the strongest part of the luxury real estate market this year has been 4-bed detached homes which saw an 18% increase in the # of sales compared to 2019 while average prices also rose by 5% to just under $3 million.

This makes complete sense when you look at the fact the average family size in Toronto is 3 people, so having a 4th room to use an office/gym/place for schooling becomes essential when all these things have to be done from home.

What’s slightly different about the 4-bed vs. 3-bed detached homes is that there seems to be a bit of negotiation happening for the 4-bed properties with an average % of listing price of 99%.

One of the things that stood out most in the stats to me was that 5-bed detached homes actually haven’t seen much an increase in demand this year when compared to the 3 & 4-bed detached properties.

The stats here are a bit conflicting as you have a 5% decrease in the average sale price to just under $4 million & an average % of listing price of 97%, which would indicate less demand/more negotiation, however the # of sales increased by 6% & the days on market dropped by 12%.

This shows that people are still looking for these types of homes, they just aren’t willing to pay as much as they did last year.

Summary

While COVID19 shocked the luxury real estate market for a short period at the beginning of this year, we have seen a consistent ramp up in demand ever since.

This is due to the fact that many people are adjusting to our "new normal" of living/working/exercising/educating from home.

As a result, we have seen even more priority being put on having a property which can comfortably accommodate all of these things, whether it be a larger condo or a larger house.

It's impossible to predict what will happen in 2021, but with another lockdown being implemented this week in Toronto causing a further delay in the return to normal work conditions, we will likely continue to see strong demand in the luxury sector.

Rylie C.

Sources

http://trreb.ca/files/market-stats/market-watch/mw1909.pdf