Toronto Real Estate Market Report | September 2023

September 2023 was a rollercoaster for the GTA housing market. Initially, the market experienced a slowdown following the Labour Day long weekend, triggered by the Bank of Canada's announcement that left interest rates unchanged.

September 2023 was a rollercoaster for the GTA housing market. Initially, the market experienced a slowdown following the Labour Day long weekend, triggered by the Bank of Canada's announcement that left interest rates unchanged.

Many buyers interpreted this as a sign that rates would continue to fall into 2024, leading them to pause their home search.

However, the market saw a shift in the last week of September. The U.S. Federal Reserve indicated that they might not be done raising rates, prompting many buyers to re-enter the market to lock in current rates.

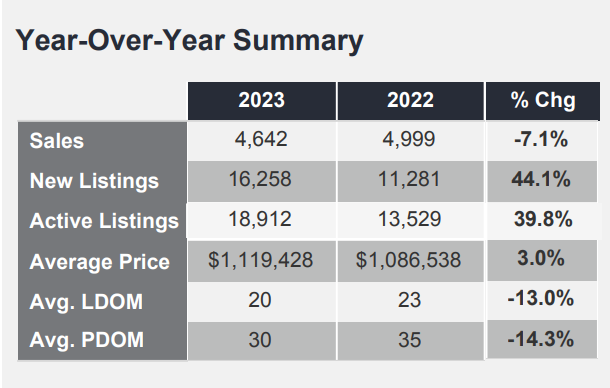

Key Statistics

- Sales: There was a 7.1% decrease, with 4,642 sales in 2023 compared to 4,999 in 2022.

- New Listings: An impressive surge of 44.1%, totaling 16,258 in 2023 up from 11,281 in 2022.

- Active Listings: Jumped by 39.8% to 18,912 in 2023 from 13,529 in the previous year.

- Average Price: Increased by 3.0% from $1,086,538 in 2022 to $1,119,428 in 2023.

- Average LDOM (List Date to Offer Made): Decreased by 13.0%, indicating faster sales.

- Average PDOM (Posting Date to Offer Made): Also decreased by 14.3%.

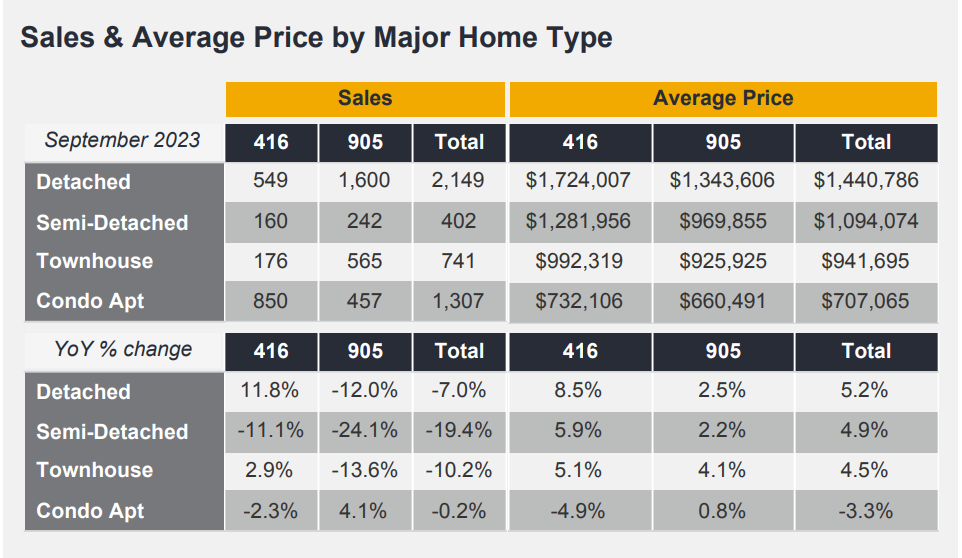

Sales & Average Price by Major Home Type (September 2023 vs. 2022)

Detached Homes

Sales: 2,149 (11.8% increase for 416 region, -12.0% decrease for 905 region)

Average Price: $1,440,786

Semi-Detached Homes

Sales: 402 (-11.1% decrease for 416 region, -24.1% decrease for 905 region)

Average Price: $1,094,074

Townhouses

Sales: 741 (2.9% increase for 416 region, -13.6% decrease for 905 region)

Average Price: $941,695

Condo Apartments

Sales: 1,307 (-2.3% decrease for 416 region, 4.1% increase for 905 region)

Average Price: $707,065

Financial Outlook

High borrowing costs are expected to remain a concern until mid-2024, after which they are likely to decrease. This could lead to a surge in housing demand by the latter half of next year, fueled by lower rates and record population growth.

Policy Implications

First-time homebuyers in Toronto face a significant hurdle with the outdated land transfer tax exemption. The average condo price has soared past $700,000, but the exemption for first-time buyers has remained at $400,000 for over 15 years.

The Toronto City Council is considering a review of this policy, emphasizing the need for cohesive housing and taxation strategies to address the ongoing housing crisis.

The market is continuously shifting right now so be sure to check back for next month's update!

Have any questions? Feel free to message me on Instagram @TorontoRealEstate.ca !

Rylie C.

Source