Toronto Real Estate Market Report ~ January 2025 | Surging Listings, Stable Prices & What’s Next

As we step into 2025, the Greater Toronto Area (GTA) housing market is showing signs of renewed activity. While home sales dipped slightly year-over-year, a surge in new listings has created more opportunities for buyers, keeping price growth moderate.

As we step into 2025, the Greater Toronto Area (GTA) housing market is showing signs of renewed activity.

While home sales dipped slightly year-over-year, a surge in new listings has created more opportunities for buyers, keeping price growth moderate.

Economic factors, including shifting mortgage rates and global trade uncertainties, are influencing market conditions, making it an interesting time for both buyers and sellers.

Market Overview: Higher Inventory, Stable Prices

GTA REALTORS® reported 3,847 home sales in January 2025, reflecting a 7.9% decrease compared to January 2024. However, the number of new listings jumped to 12,392, marking a 48.6% increase year-over-year. This rise in inventory led to a 70.2% increase in active listings, giving buyers more options and negotiating power.

Despite more supply, home prices remained stable, with the average selling price rising 1.5% year-over-year to $1,040,994. The MLS® Home Price Index Composite benchmark also saw a slight increase of 0.44% year-over-year, indicating steady demand.

Sales and Average Prices by Home Type (January 2025)

- Detached Homes:

- Sales: 1,580 (351 in 416, 1,229 in 905)

- Average Price: $1,377,430 ($1,579,386 in 416, $1,319,751 in 905)

- YoY Sales Change: -8.4% (+3.8% in 416, -11.4% in 905)

- YoY Price Change: +2.1% (+1.0% in 416, +1.8% in 905)

- Semi-Detached Homes:

- Sales: 349 (132 in 416, 217 in 905)

- Average Price: $1,047,728 ($1,154,505 in 416, $982,776 in 905)

- YoY Sales Change: +2.9% (+25.7% in 416, -7.3% in 905)

- YoY Price Change: +1.1% (-3.7% in 416, +2.0% in 905)

- Townhouses:

- Sales: 725 (147 in 416, 578 in 905)

- Average Price: $904,986 ($941,893 in 416, $895,600 in 905)

- YoY Sales Change: -4.2% (+15.7% in 416, -8.3% in 905)

- YoY Price Change: +1.6% (+5.1% in 416, +0.6% in 905)

- Condo Apartments:

- Sales: 1,161 (747 in 416, 414 in 905)

- Average Price: $670,675 ($691,039 in 416, $633,932 in 905)

- YoY Sales Change: -12.1% (-14.5% in 416, -7.4% in 905)

- YoY Price Change: -1.6% (-2.4% in 416, +0.8% in 905)

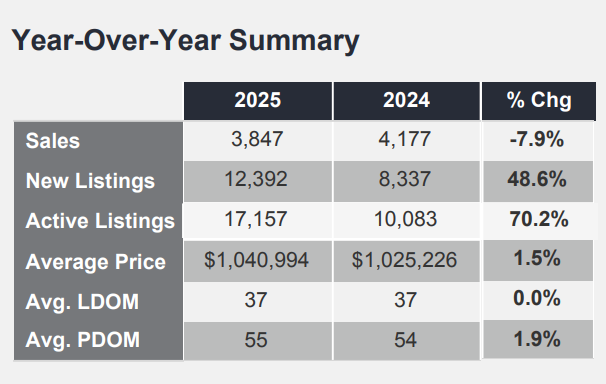

Year-Over-Year Summary (January 2025)

- Total Sales: 3,847 (2025) vs. 4,177 (2024), a 7.9% decrease

- New Listings: 12,392 (2025) vs. 8,337 (2024), a 48.6% increase

- Active Listings: 17,157 (2025) vs. 10,083 (2024), a 70.2% increase

- Average Price: $1,040,994 (2025) vs. $1,025,226 (2024), a 1.5% increase

- Average LDOM (Listing Days on Market): 37 days, unchanged from 2024

- Average PDOM (Property Days on Market): 55 days (2025) vs. 54 days (2024), a 1.9% increase

What’s Driving the Market?

With a strong inventory of homes available, price growth in the GTA is expected to remain in line with inflation throughout 2025.

However, lower borrowing costs are expected to bring more buyers off the sidelines, particularly heading into the spring market.

TRREB’s 2025 forecast anticipates:

- 76,000 total home sales, up 12.4% over 2024

- An average selling price of $1,147,000, a 2.6% increase

- Stronger price growth in single-family homes, while condo prices remain stable due to high supply

While lower interest rates should improve affordability, economic uncertainties such as trade disruptions and consumer confidence shifts may offset some of these gains.

Additionally, stalled pre-construction condo sales could worsen the supply-demand imbalance in the years ahead. (Reuters)

Final Thoughts

The GTA real estate market started 2025 with strong inventory levels and steady price growth, creating opportunities for buyers.

While detached and semi-detached homes remain resilient, the condo market continues to favour buyers with plenty of supply.

As borrowing costs decline further, expect market activity to pick up in the coming months, making spring 2025 a key period for both buyers and sellers.

Rylie C.

Sources

https://trreb.ca/wp-content/files/market-stats/market-watch/mw2501.pdf