Toronto Real Estate Market Report ~ February 2025 | Increasing Inventory, Economic Shifts & Buyer Hesitation

The Toronto housing market continued to shift in favour of buyers in February 2025, as home sales declined sharply while listings remained elevated.

The Toronto housing market continued to shift in favour of buyers in February 2025, as home sales declined sharply while listings remained elevated. However, the real estate landscape is being shaped by economic uncertainty, global trade tensions, and shifting consumer confidence, which are all influencing buyer and seller behaviour.

While average home prices dipped slightly, the market remains well-supplied, giving buyers increased negotiating power.

However, economic and political uncertainty—such as trade relations with the U.S., interest rate trends, and affordability concerns—are prompting some to wait on the sidelines.

Market Overview: High Inventory & Slower Sales

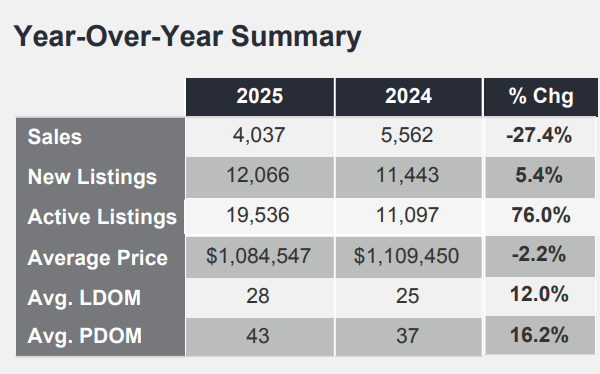

GTA REALTORS® reported 4,037 home sales in February 2025, marking a 27.4% decline from February 2024. Meanwhile, new listings increased by 5.4% to 12,066, keeping market conditions competitive.

With active listings up a staggering 76% year-over-year, the market has tilted towards buyers, providing ample choice and greater room for negotiation. However, longer days on market and hesitancy due to economic factors have slowed transactions.

The average home price fell 2.2% year-over-year to $1,084,547, while the MLS® Home Price Index Composite benchmark dropped 1.8%. Seasonally adjusted numbers show that both sales and prices declined month-over-month, reflecting ongoing buyer caution.

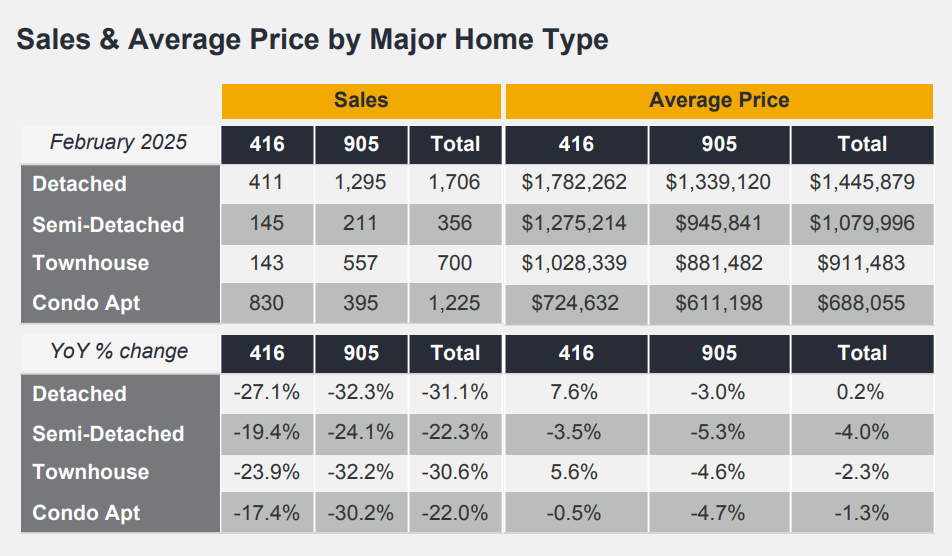

Sales and Average Prices by Home Type (February 2025)

- Detached Homes:

- Sales: 1,706 (411 in 416, 1,295 in 905)

- Average Price: $1,445,879 ($1,782,262 in 416, $1,339,120 in 905)

- YoY Sales Change: -31.1% (-27.1% in 416, -32.3% in 905)

- YoY Price Change: +0.2% (+7.6% in 416, -3.0% in 905)

- Semi-Detached Homes:

- Sales: 356 (145 in 416, 211 in 905)

- Average Price: $1,079,996 ($1,275,214 in 416, $945,841 in 905)

- YoY Sales Change: -22.3% (-19.4% in 416, -24.1% in 905)

- YoY Price Change: -4.0% (-3.5% in 416, -5.3% in 905)

- Townhouses:

- Sales: 700 (143 in 416, 557 in 905)

- Average Price: $911,483 ($1,028,339 in 416, $881,482 in 905)

- YoY Sales Change: -30.6% (-23.9% in 416, -32.2% in 905)

- YoY Price Change: -2.3% (+5.6% in 416, -4.6% in 905)

- Condo Apartments:

- Sales: 1,225 (830 in 416, 395 in 905)

- Average Price: $688,055 ($724,632 in 416, $611,198 in 905)

- YoY Sales Change: -22.0% (-17.4% in 416, -30.2% in 905)

- YoY Price Change: -1.3% (-0.5% in 416, -4.7% in 905)

Year-Over-Year Summary (February 2025)

- Total Sales: 4,037 (2025) vs. 5,562 (2024), a 27.4% decrease

- New Listings: 12,066 (2025) vs. 11,443 (2024), a 5.4% increase

- Active Listings: 19,536 (2025) vs. 11,097 (2024), a 76.0% increase

- Average Price: $1,084,547 (2025) vs. $1,109,450 (2024), a 2.2% decrease

- Average LDOM (Listing Days on Market): 28 days (2025) vs. 25 days (2024), a 12.0% increase

- Average PDOM (Property Days on Market): 43 days (2025) vs. 37 days (2024), a 16.2% increase

Economic & Political Factors Impacting the Market

1. Trade Tensions with the U.S.

The recent 25% tariff imposed by the U.S. on Canadian imports has raised concerns about economic growth, while Canada has responded with its own tariffs on $155 billion of U.S. goods. Analysts warn that these trade disruptions could lead to higher consumer prices and job losses, further impacting consumer confidence in the housing market. (Reuters)

2. Bank of Canada Interest Rate Policy

The Bank of Canada has implemented interest rate cuts to stimulate economic growth, but affordability concerns persist. Lower mortgage rates are expected in the coming months, which could help drive renewed buyer activity in the second half of 2025. (BMO Capital Markets)

3. Consumer Confidence & Economic Growth

With trade tensions rising and Canada's economic growth forecasted at 1.8% for 2025, consumer confidence remains uncertain. While inflation is expected to remain stable, job security and rising costs of goods could continue to impact purchasing decisions. (Bank of Canada)

What This Means for Buyers & Sellers

🔹 For Buyers:

With high inventory levels, this is one of the most buyer-friendly markets in recent years. Those who lock in a property before mortgage rates drop further may benefit from lower competition and stronger negotiating power.

🔹 For Sellers:

Selling in this market requires competitive pricing and strong marketing. Detached homes in Toronto saw a 7.6% price increase, signaling strength in this segment, while condos remain the most negotiable.

🔹 For Investors:

With trade tensions and economic uncertainty keeping some buyers out of the market, rental demand may rise, creating opportunities for investors looking to capitalize on increased tenant demand.

Looking Ahead: Is the Market Poised for a Comeback?

If borrowing costs trend lower and economic concerns stabilize, home sales are expected to pick up in the second half of 2025.

However, until interest rates drop significantly, buyers will continue to have the upper hand with more inventory, longer days on market, and room for negotiation.

For now, those looking to buy may find this a great opportunity to secure a property before the competition increases later this year.

Have any questions about the market? Let me know in the comments below!

Rylie C.

https://trreb.ca/wp-content/files/market-stats/market-watch/mw2502.pdf