Toronto Luxury Real Estate | Market Report | April 2021

March is quite an interesting month to look at as one year ago when the pandemic first hit, the market was brought to a screeching halt with a drastic reduction in the number of sales.

Welcome to the monthly Toronto Luxury Market Report where we'll look at what's been happening in the home & condo sectors for March 2021.

This is quite an interesting month to look at as one year ago when the pandemic first hit, the market was brought to a screeching halt with a drastic reduction in the number of sales.

Since then, the real estate market has gone into overdrive since everyone is spending more time at home & typically needed more space which prompted many people to move.

This shift can easily be seen when we compare the number of overall home/condo sales last March which reached just under 8000 (7945 to be exact) whereas this year we reached 15,652 sales which works out to a 97% increase.

New listings accurately reflect this shift as well since last March totalled 14,434 listings compared to this year where we saw 22,709 listings come on the market which translates to a 57% increase.

Average sale prices followed this trend with a 21.6% increase over March 2020 with the average price rising from $902,787 last year to just under $1.1 million this year ($1,097,565).

Spring is normally our busiest time of the year so it will be interesting to see what happens through April & May as more confidence comes back into the economy as the COVID19 vaccine rollout reaches more people.

Stats

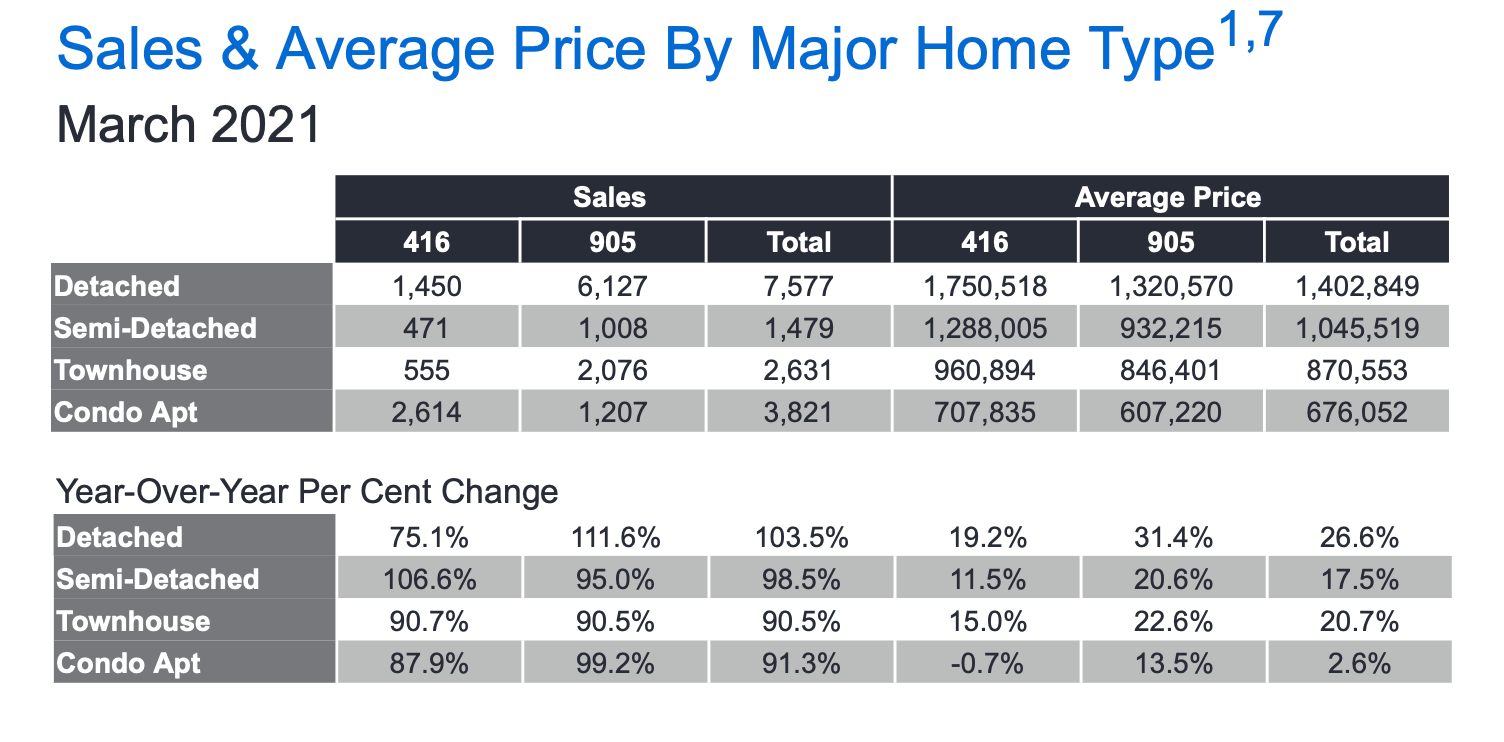

The detached home sector in both Toronto & the surrounding 905-areas led the pack for appreciation out of any property type for the month of March.

Toronto experienced a 19.2% increase in prices for detached homes to just over $1.75 million while the 905-areas saw a 31.4% increase to an average price of $1,320,570.

Surprisingly the townhouse sector outperformed semi-detached properties in both of these geographic areas with a 15% rise in Toronto to $960,894 & a 22.6% increase in the 905's to $846,401.

Even though it was beat out by detached & townhouse properties, the semi-detached market still performed quite well with an 11.5% increase in Toronto to an average price of $1,288,005 while the 905's experienced a 20.6% increase to $932,215.

The condo sector in Toronto was the only type of property that saw a decline in average sale price to $707,835 which reflects a 0.7% decrease from last year. The complete opposite was true for 905 condos as they experienced a 13.5% increase in average price to $607,220.

This drastic surge in the 905 areas largely comes down to affordability as people want to enter the housing market but many of them have been priced out of Toronto.

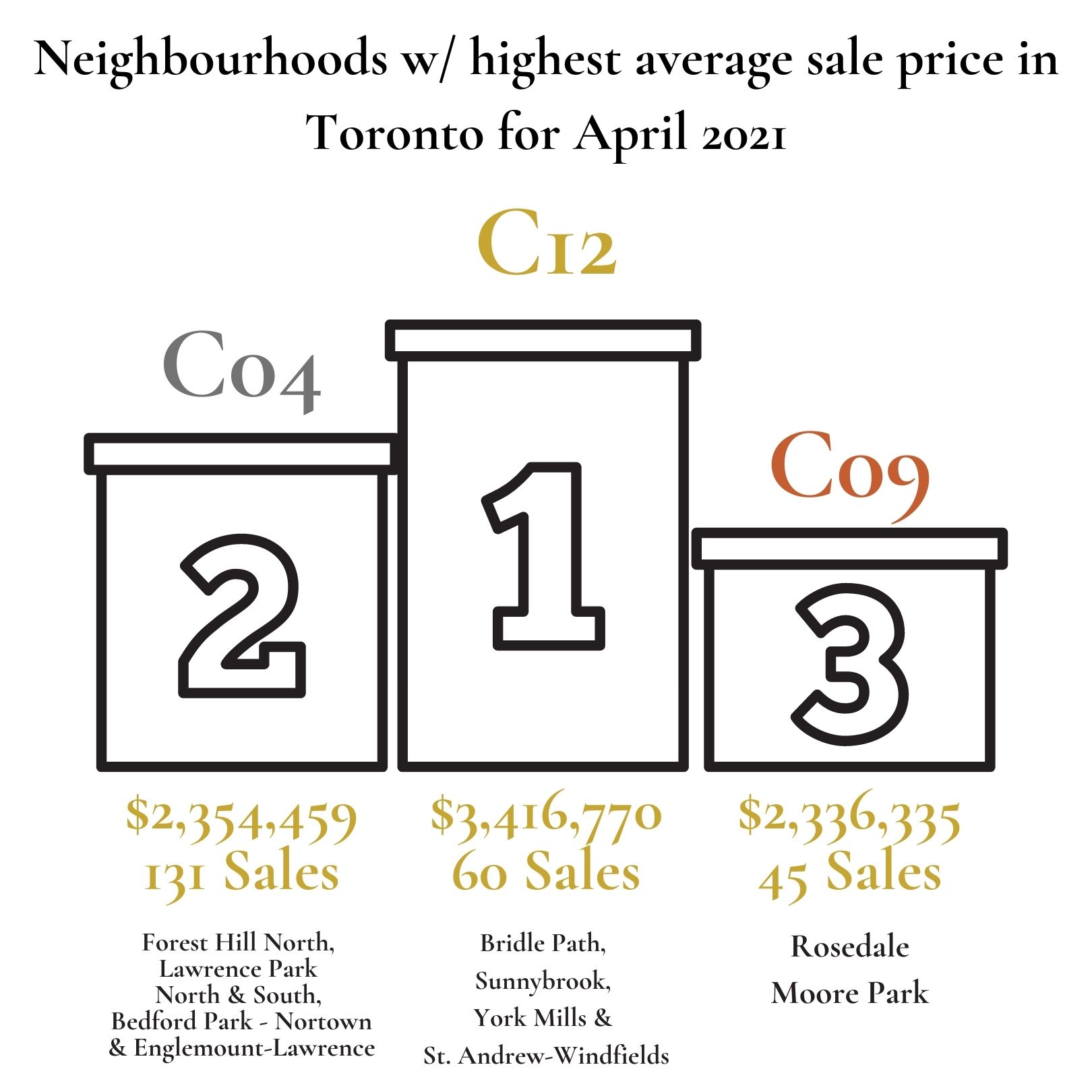

Neighbourhoods w/ highest average sale price in Toronto for March 2021

#1 = C12 - $3,416,770 - 60 Sales

Bridle Path, Sunnybrook, York Mills & St. Andrew-Windfields

#2 = C04 - $2,354,459 - 131 Sales

Forest Hill North, Lawrence Park North & South, Bedford Park - Nortown & Englemount-Lawrence

#3 = C09 - $2,336,335 - 45 Sales

Rosedale - Moore Park

#4 = C02 - $1,686,008 - 114 Sales

Annex, Casa Loma, Wychwood & Yonge - St.Clair

#5 = C03 - $1,597,030 - 86 Sales

Forest Hill South, Homewood-Cedarvale & Oakwood-Vaughan

Summary

As provincial lockdowns continue throughout Ontario, we should expect to see these type of market conditions continue as mortgage interest rates remain low & there is renewed confidence in the overall economy.

We are already starting to see a shift in the Toronto condo market becoming more competitive for several reasons.

Firstly, a lot of the 2/3-bed condo buyers that had decided to focus on the housing market last year have returned to the condo market since they were unsuccessful in purchasing a home due to the high levels of competition in the $800k - 1.1 million sector.

Secondly, many people are pre-empting the return to in-office work & want to minimize their commute so they don't have to be stuck in traffic (which is worse than pre-COVID levels) or have to use public transit.

Lastly, there are numerous investors returning to the market who are purchasing entry-level condos for rental purposes as prices are expected to start rising later this year.

Only time will tell but it could be another record-setting year for the Toronto housing market.

Have any questions or concerns?

Let me know in the comments section below!

Rylie C.

Source