Toronto Real Estate Market Report - Q1 2024 | Has Toronto passed the bottom of the market?

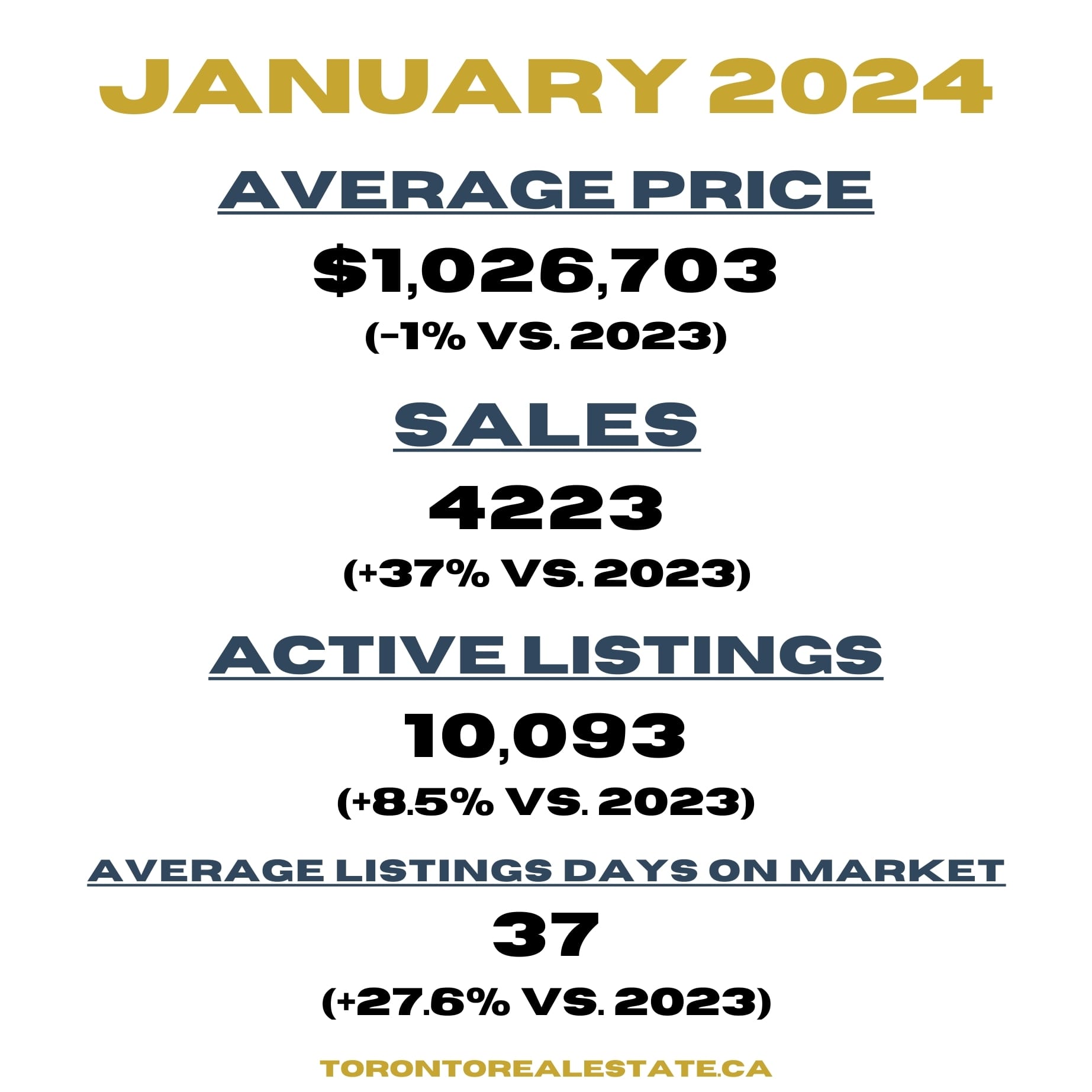

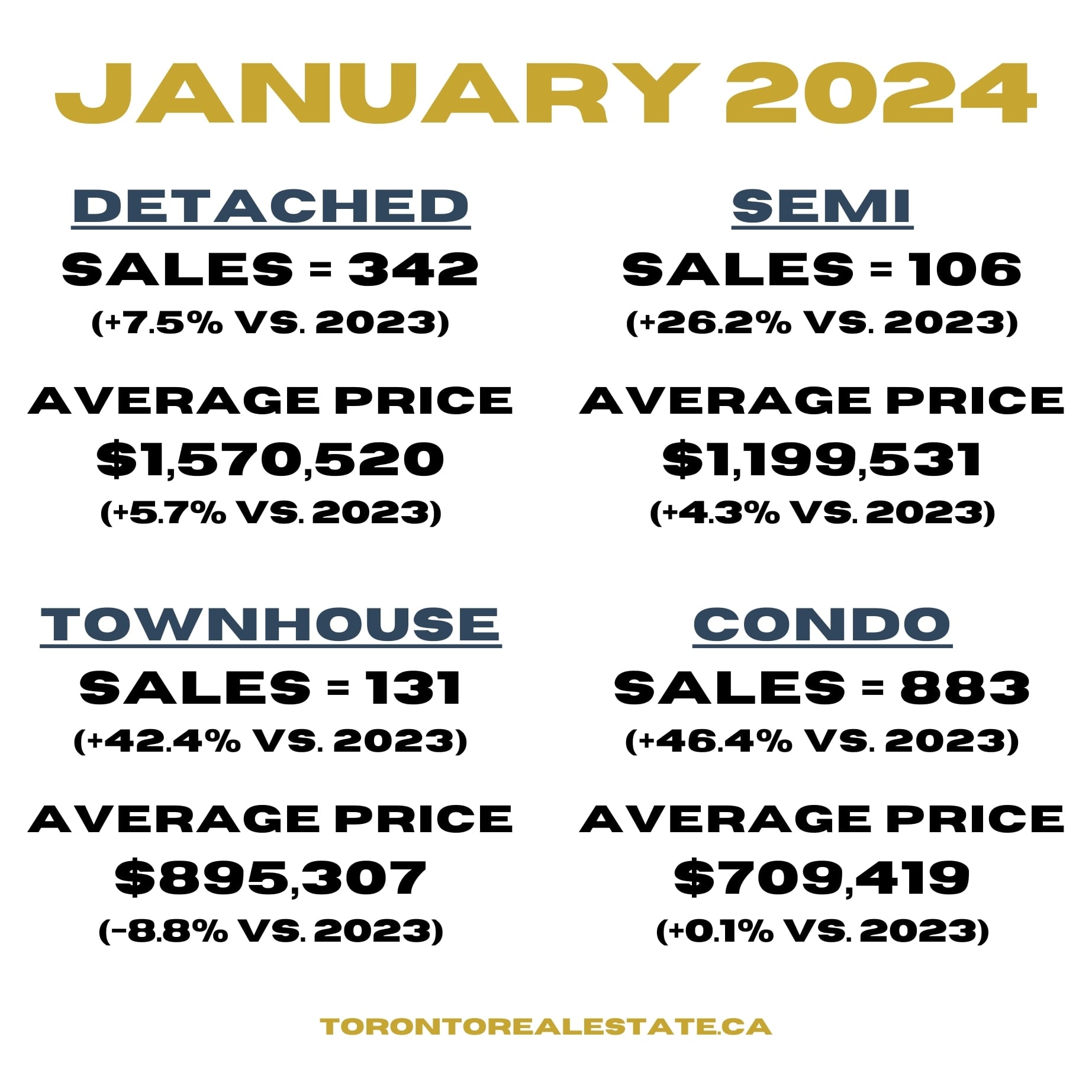

The year started off with a strong surge of sales compared to the same period in 2023 with condos seeing the biggest increase (+46.4%) as many new construction projects take occupancy.

Average listing days on market was over one month (37 days) which reflected the reluctance of many sellers to adapt to the market prices.

Detached homes prevailed as the strongest sector with a steady increase of almost 6% in average price compared to January 2023.

This largely stems from desirable neighbourhoods like East York, The Beaches, Rosedale, etc. having strong demand due to the buyer pool not being as affected by higher interest rates (many have accrued equity in existing properties which helps offset the financing costs).

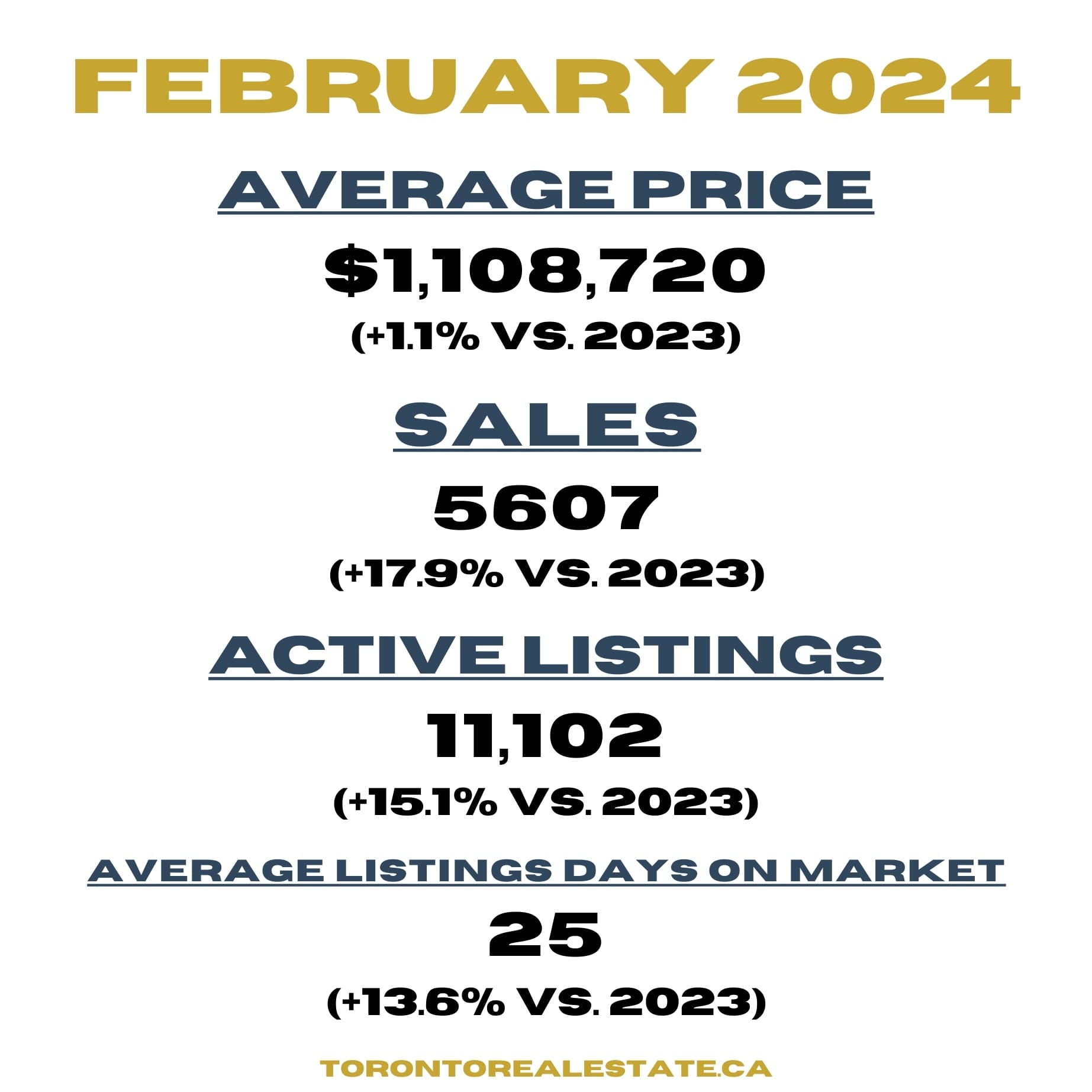

Things started to pick up quite a bit in February with almost 18% higher sales compared to 2023 with detached & semi-detaches homes being the largest driver of this.

This could possibly be in response to the Bank of Canada announcement on January 24th where they decided to hold rates which provided confidence to buyers that borrowing costs would likely decrease in the future.

The increased number of active listings (+15.1%) almost matches identically to the increase in sales (+17.9%) which makes sense as sellers react to increased competition.

The 5% reduction of sales in March is somewhat an anomaly for this time of year as we typically see things ramp up as Spring starts and the weather gets better.

The overall poor weather throughout the month could have played a factor in this but also could be slower as some buyers pull back in hopes of getting a better interest rates in the coming months.

The surge in active listings (23.1%) showed that many sellers were expecting a more active Spring market but the conditions didn’t materialize as expected

One notable factor is that average listing days on market dropped to 20 which is much lower than the start of 2024 & shows that buyers were willing to act quicker, particularly when properties were priced properly for today’s market.

We have started to see more properties employ the holding off on offers/under-pricing strategy again as market conditions become more competitive.

On the converse side, we are still seeing a lot of properties over-priced for today’s market and then sitting on the market before doing a series of price reductions (sometimes in the realm of $100-200k)

My prediction is that we will have a hyper-competitive Summer market that will be very similar to the conditions we had in 2021 when prices/demand were surging like crazy.

We will likely see many of the buyers who have been sidelined for the past 6-12 months return as interest rates are projected to decrease sometime in Q2.

Additionally, lots of buyers are taking alternative financing options like 1 or 3-year fixed rates or going onto variable mortgages as they expect borrowing costs to decrease over the coming years

What do you think is going to happen with the Toronto real estate market this year?

Let me know your thoughts in the comments below!

Rylie C.

Sources

https://trreb.ca/files/market-stats/market-watch/mw2401.pdf