Mortgage renewal in 2024? Here's how to get a lower rate

For homeowners in Canada looking to renewal their mortgage in 2024, many of the current prospects are quite awful when compared to the very low rates they've been accustomed to seeing over the past 5 years.

For homeowners in Canada looking to renewal their mortgage in 2024, many of the current prospects are quite awful when compared to the very low rates they've been accustomed to seeing over the past 5 years.

When many homeowners purchased their property at the height of the market in 2019/2020, interest rates for a 5-year fixed mortgage were typically in the 2.5-3% range.

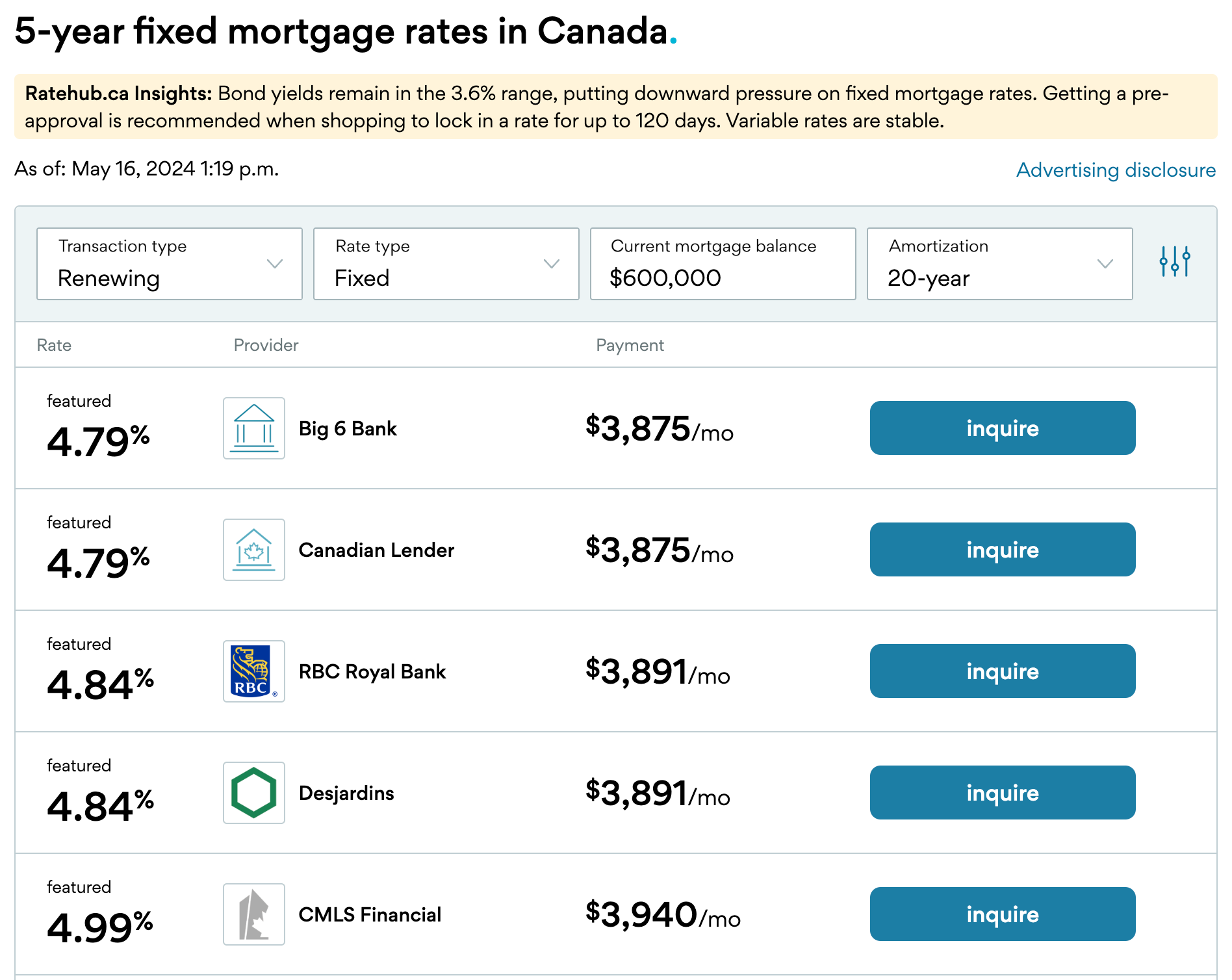

Currently, that same 5-year fixed mortgage rate is close to 5% which means that mortgage payments for many will double come their renewal should they choose this length of term (which many aren't).

With the prospect of lower interest in the coming months from the Bank of Canada, we are increasingly seeing people choose alternative lending options such as variable rate mortgages for a shorter term (2/3 years vs. 5).

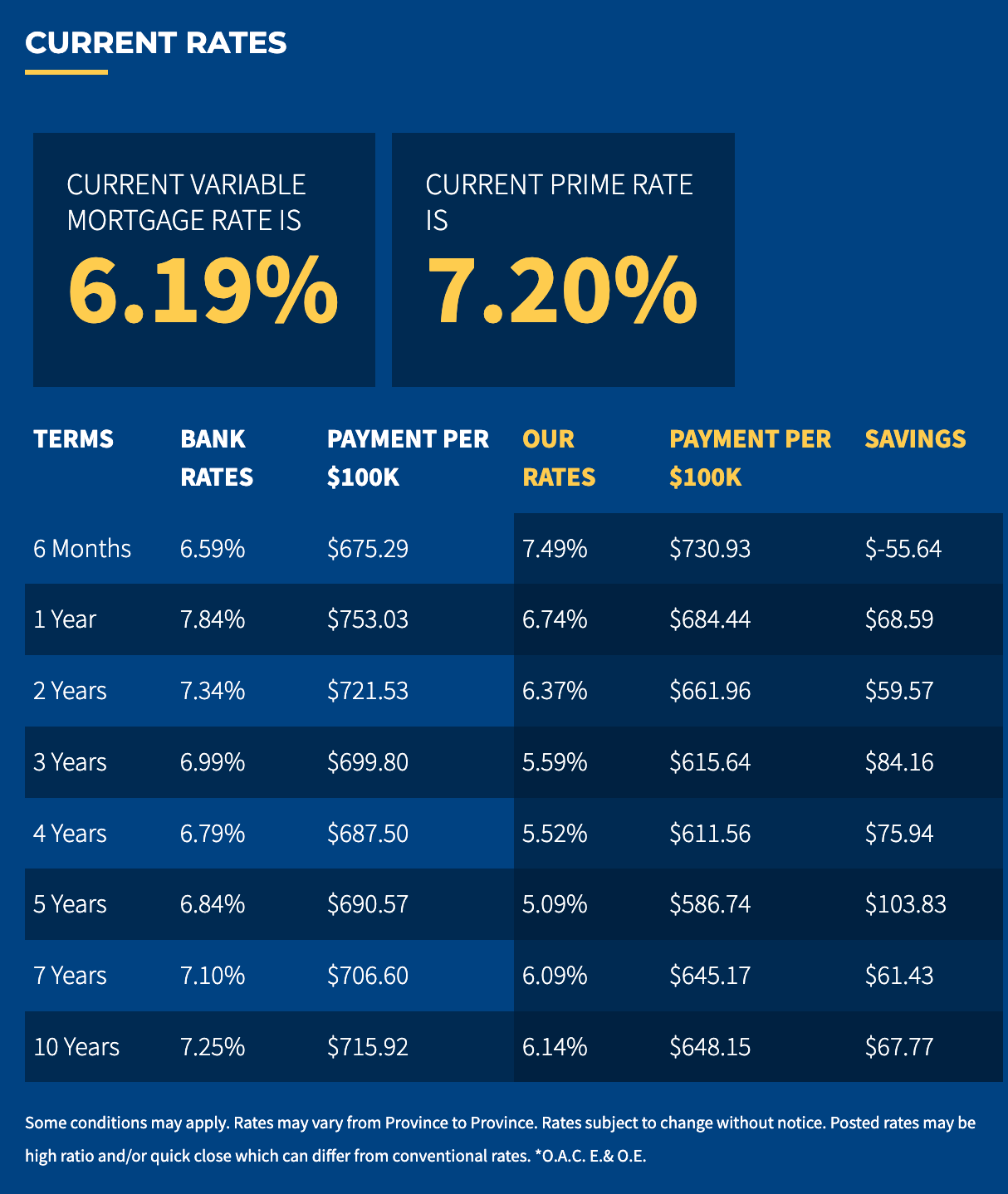

Here are some examples of variable rates being offered by companies like Dominion Lending who are able to shop around at multiple banks & lending sources on your behalf to get the best prices.

As you can see, there is a quite a large savings by going with a mortgage broker vs. directly with the bank at an average savings of $50-100 per month.

So how do you get your mortgage payments lower in 2024?

1.) Use a mortgage broker or call around to multiple banks to determine who is offering the best rates.

While this can take a bit more time, the added effort of sourcing out the best lender will ultimately net you savings at the end of the day instead of going only to one bank.

Mortgage brokers usually have access to various lending schemes that the typical homeowner wouldn't be aware of so be sure to utilize this service as their's no direct cost to you as a client.

2.) Think about a shorter term loan

There are some analysts suggesting that we could see rates return to levels below 3% by 2025. If this is the case, taking a mortgage term of 1-2 years may be more beneficial if you prefer fixed rates as it gives you flexibility to renew when rates are (hopefully) better.

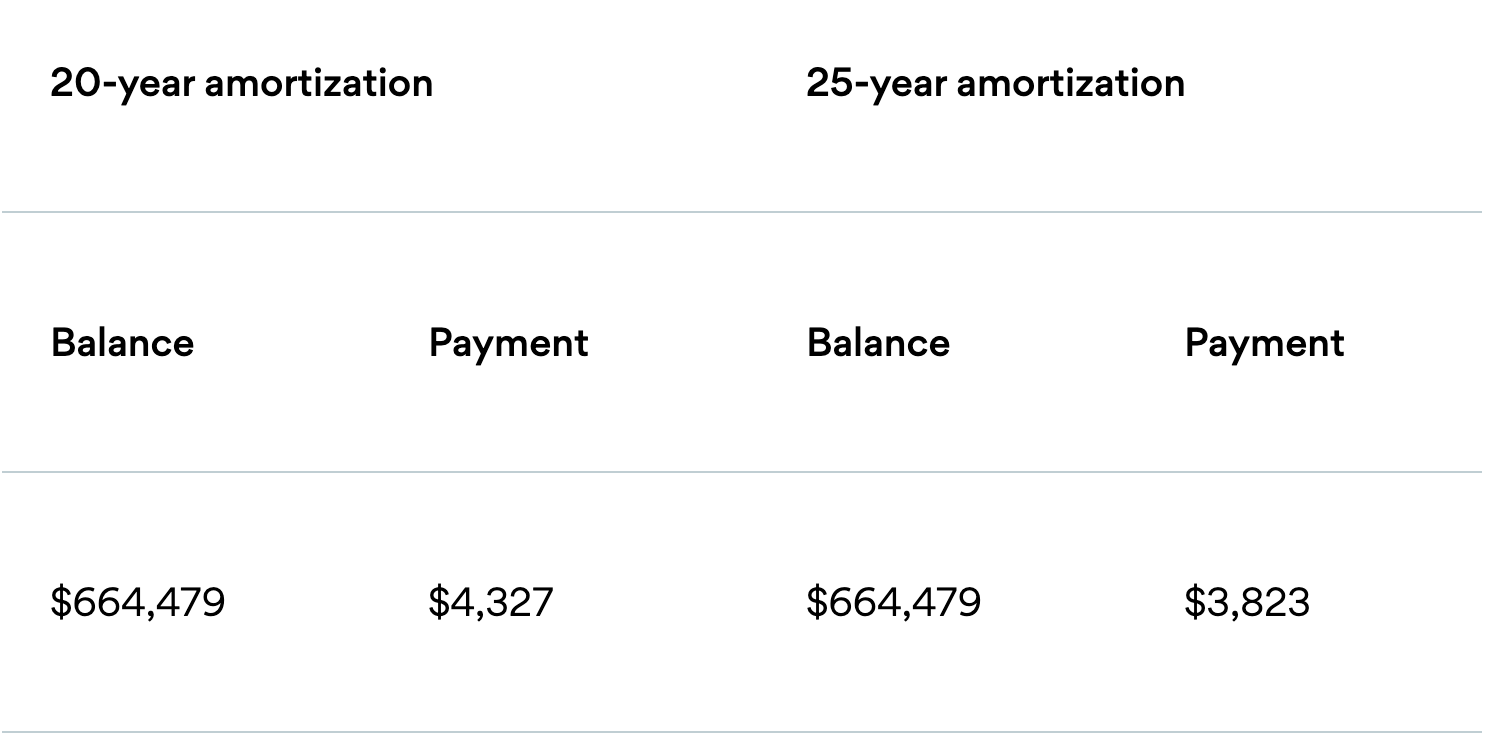

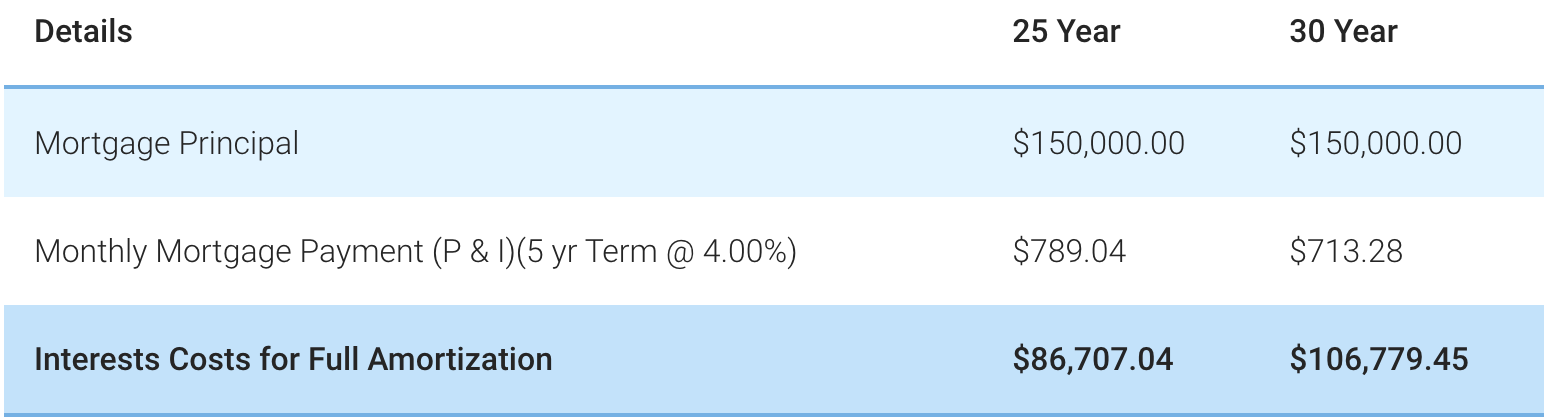

3.) Extend your mortgage amortization period

While this option would ultimately have you paying more in interest for your mortgage as it elongates the amount of years you have to be paying for your home, it will create a substantial reduction in your monthly mortgage payments right away.

While it's not an easy time to be thinking about your mortgage renewal, the good news is that we are generally trending in the right direction with the prospect of lower rates starting as soon as next month.

Need recommendations for Mortgage Brokers to help you out?

Feel free to message me on Instagram @TorontoRealEstate.ca!

Rylie C.